Why Offshore Investment Plays a Vital Duty in International Wealth Monitoring

Why Offshore Investment Plays a Vital Duty in International Wealth Monitoring

Blog Article

All About Offshore Financial Investment: Insights Into Its Considerations and benefits

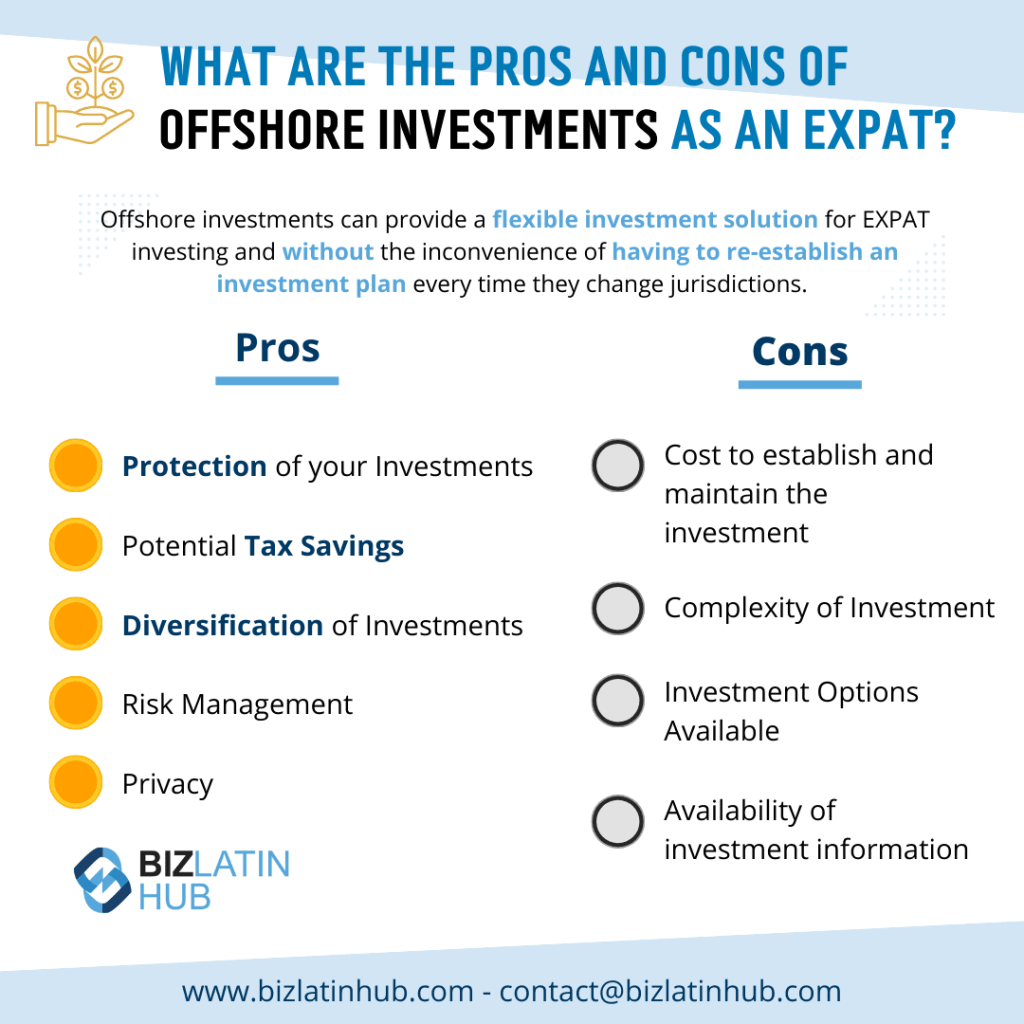

Offshore investment has ended up being a progressively appropriate subject for individuals looking for to expand their profiles and enhance monetary protection. While the possible benefits-- such as tax optimization and asset defense-- are compelling, they include a complex landscape of threats and governing obstacles that need cautious factor to consider. Recognizing both the benefits and the pitfalls is vital for anyone considering this investment approach. As we discover the nuances of offshore investment, it ends up being evident that informed decision-making is essential for maximizing its possible benefits while mitigating fundamental dangers. What variables should one prioritize in this complex environment?

Recognizing Offshore Financial Investment

In the world of global financing, comprehending overseas financial investment is essential for people and entities seeking to maximize their monetary profiles. Offshore investment describes the placement of properties in monetary establishments outside one's country of home. This practice is usually utilized to achieve numerous monetary goals, including diversification, property security, and prospective tax obligation benefits.

Offshore investments can encompass a vast variety of monetary instruments, consisting of supplies, bonds, common funds, and realty. Financiers may choose to develop accounts in territories recognized for their desirable regulative environments, privacy regulations, and financial security.

It is vital to recognize that overseas financial investment is not naturally identified with tax evasion or illicit activities; instead, it offers genuine functions for many investors. The motivations for taking part in overseas financial investment can differ extensively-- from seeking greater returns in developed markets to securing properties from financial or political instability in one's home country.

However, prospective financiers should additionally understand the complexities involved, such as compliance with international policies, the necessity of due diligence, and recognizing the legal implications of offshore accounts. In general, a comprehensive understanding of overseas investment is important for making enlightened financial choices.

Key Benefits of Offshore Financial Investment

Offshore investment provides several essential advantages that can boost a financier's monetary method. One noteworthy benefit is the capacity for tax optimization. Lots of overseas jurisdictions offer favorable tax obligation regimes, allowing financiers to reduce their tax obligations legally. This can significantly boost overall rois.

In addition, overseas financial investments frequently supply accessibility to a wider series of financial investment chances. Investors can diversify their portfolios with properties that might not be conveniently offered in their home countries, consisting of international stocks, genuine estate, and specialized funds. This diversity can lower risk and boost returns.

Additionally, overseas financial investments can facilitate estate planning. They enable financiers to structure their assets in such a way that decreases estate taxes and guarantees a smoother transfer of riches to heirs.

Common Risks and Obstacles

Investing in overseas markets can present different dangers and difficulties that need This Site careful consideration. One considerable danger is market volatility, as overseas financial investments may go through fluctuations that can influence returns significantly. Investors should likewise recognize geopolitical instability, which can disrupt markets and influence financial investment performance.

An additional obstacle is currency danger. Offshore financial investments often include transactions in foreign currencies, and undesirable exchange rate motions can deteriorate earnings or boost losses. Offshore Investment. In addition, limited access to dependable information regarding offshore markets can prevent educated decision-making, bring about potential missteps

Lack of regulative oversight in some offshore jurisdictions can additionally present risks. Financiers may discover themselves in settings where investor security is very little, raising the danger of fraud or mismanagement. In addition, varying monetary practices and cultural attitudes towards investment can complicate the financial investment procedure.

Legal and Regulative Considerations

While navigating the intricacies of offshore financial investments, comprehending the regulative and lawful landscape is critical for making sure and safeguarding assets compliance. Offshore investments are typically based on a wide variety of guidelines and laws, both in the capitalist's home nation and the territory where the investment is made. For that reason, it is important to carry out detailed due persistance to understand the tax obligation effects, reporting needs, and any legal responsibilities that may occur.

Regulatory structures can vary substantially between territories, impacting every little thing from taxation to capital demands for international financiers. Some countries may supply favorable tax obligation programs, while others impose rigorous laws that could prevent investment. Additionally, worldwide contracts, such as FATCA (International Account Tax Obligation Conformity Act), may obligate financiers to report overseas holdings, increasing the requirement for openness.

Financiers must likewise understand anti-money laundering (AML) and know-your-customer (KYC) laws, which require banks to confirm the identification of their clients. Non-compliance can lead to severe fines, including penalties and constraints on investment activities. Engaging with legal specialists specializing in international financial investment regulation is crucial to navigate this detailed landscape successfully.

Making Informed Decisions

A critical strategy is necessary for making informed decisions in the world of overseas financial investments. Comprehending the intricacies included requires detailed research and evaluation of different factors, including market fads, tax effects, and lawful frameworks. Capitalists should examine their danger resistance and investment objectives, guaranteeing positioning with the one-of-a-kind attributes of offshore chances.

Inspecting the governing atmosphere in the picked territory is crucial, as it can considerably influence the safety and earnings you could check here of investments. Furthermore, remaining abreast of geopolitical developments and economic problems can give valuable understandings that educate investment approaches.

Engaging with professionals that focus on offshore investments can also boost decision-making. Offshore Investment. Their experience can lead financiers via the intricacies of worldwide markets, aiding to determine lucrative chances and possible challenges

Ultimately, informed decision-making in overseas additional hints financial investments hinges on a well-rounded understanding of the landscape, a clear expression of individual objectives, and a dedication to recurring education and learning and adjustment in a vibrant international setting.

Verdict

In verdict, offshore investment offers significant advantages such as tax optimization, property security, and accessibility to international markets. By resolving these considerations, capitalists can effectively harness the benefits of offshore financial investments while reducing prospective downsides, ultimately leading to informed and tactical monetary decisions.

Offshore investment supplies numerous vital benefits that can boost a financier's monetary strategy.In addition, offshore financial investments commonly give access to a wider variety of investment chances. Differing financial methods and cultural mindsets towards investment can make complex the investment procedure.

Report this page